pixelfit/Getty Images

- The book value of a company is the total worth of all its assets minus all its liabilities.

- Investors compare a company’s book value to its stock price, to judge if shares are under- or overpriced.

- Book value works best on hard-goods companies, vs service providers or firms with intangible assets.

- Visit Business Insider’s Investing Reference library for more stories.

When investigating which stocks to buy, Investors often have to look hard into companies’ financials. One of the big things they look at is book value.

Book value is a calculation that aims to determine the actual, complete worth of a company, based on its assets. It’s basically the break-up value – the amount that the company would be worth if it were liquidated.

Investors use book value to help them judge if a company’s stock is overpriced or underpriced.

Let’s dive more deeply into book value, how it’s calculated, and its significance.

What is book value?

Book value actually has two related meanings. In the accounting world, book value refers to the worth of a particular asset on a company’s balance sheet – say, a piece of property or equipment. The book value of the asset is its original cost, minus depreciation (its declining value as it ages or gets used up). It’s mainly used for tax purposes.

In the investing/financial world, book value's meaning is an expanded, extrapolated version of the first definition. It's the total value of all the company's assets - the worth of all the goods, properties, funds, and other things it owns - minus its liabilities - its expenses and debts. Usually, the worth of any intangible assets, like intellectual property or patents, is subtracted too.

This sum aims to put a number on what a company's actually "worth." It's the amount that theoretically represents the company's breakup value. If the company went under or was dismantled and sold off, this book value would be used to determine what individual stockholders would receive - roughly, the cash value of their individual shares.

How to calculate book value and book value per share

Book value is not often included in a company's stock listings or online profile. To find its book value, you have to look at its financial statements, and all the assets and liabilities listed on its balance sheets. Add up all the assets, subtract all the liabilities and the result is the book value.

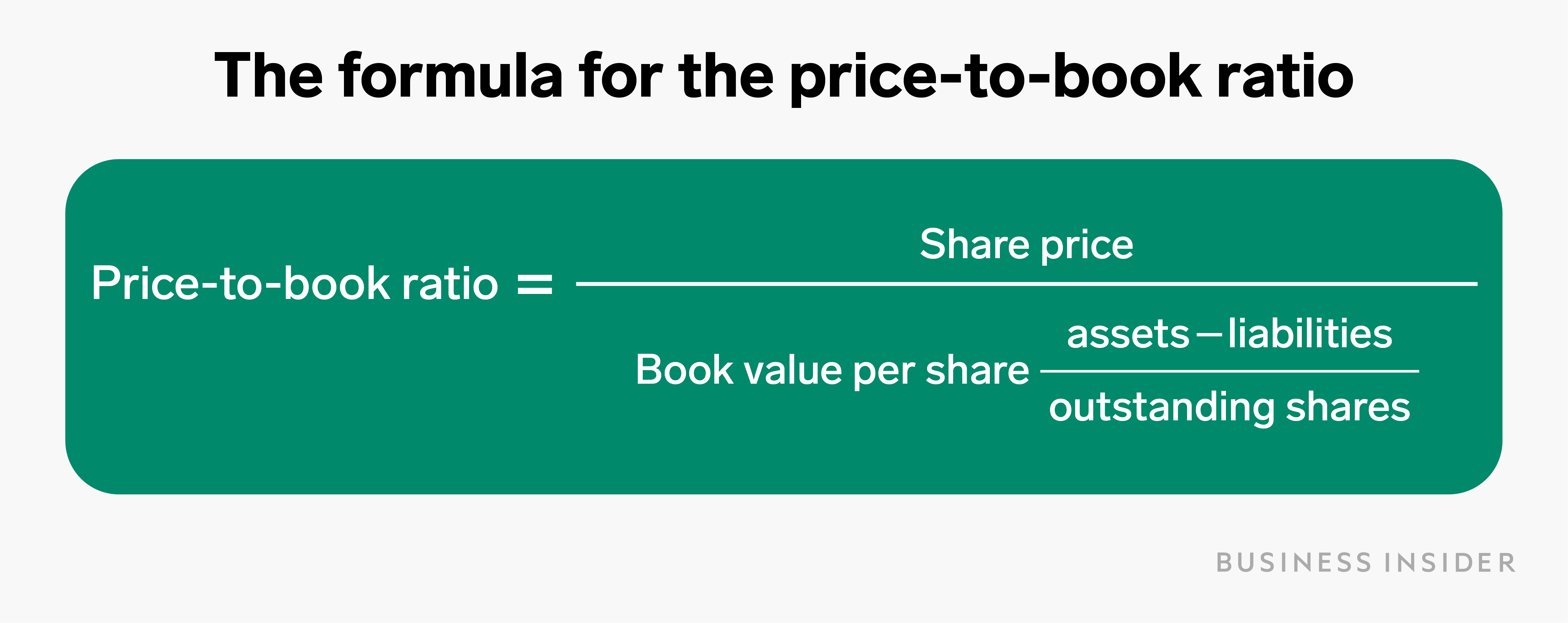

When evaluating a company, book value can be calculated as:

What is book value per share?

While you have to calculate book value yourself, most online stock listings do include a related metric that's also useful to investors: the book value per share (BVPS). Book value per share shows how much in dollar terms each share will receive if a company is liquidated and its creditors are paid off.

Expressed as a dollar amount, BVPS breaks the company's overall book value down by dividing it by all the company's outstanding shares, to come up with a per-share amount. This amount can be compared to the share's current trading price.

Some sites also list this as a single figure, called the price-to book ratio.

Yuqing Liu/Business Insider

For example, in late January 2021, Microsoft Corp. (MSFT) had a book value per share of $24.65, and a price to book ratio of 14, compared to a share price of $242.

How investors use book value

Book value, book value per share, and the price to book value are measures prized by believers in value investing. This investment strategy boils down to bargain-hunting: Rather than targeting the best-performing equities, it seeks out low-priced, neglected stocks in the hope that their share prices will eventually rise again.

To find their bargains, value investors look at a company's book value and book value per share. If a stock is trading below its book value, it could be a good buy - an undiscovered gem.

If the book value per share is higher than its market value per share - the stock's current trading price - then it can indicate an undervalued stock. If the book value per share is lower than its market value per share, it can indicate an overpriced, or overvalued stock.

The reasoning for this is that book value per share represents the financial strength of a company based on its assets, an objective number, whereas market value per share represents the attractiveness of a company's shares in the marketplace, a subjective number.

The limits of book value

Book value is best used with companies that have physical assets, such as factories, machinery, and other equipment, as opposed to companies that don't have many physical assets, such as technology firms that primarily operate on an idea or service provided online, such as Facebook or Netflix.

These companies mainly have intangible assets, such as intellectual property, that are the bulk of their value. So when calculating book value for companies like this and comparing them to their market value, it's essential to understand why the book value number is what it is.

With these sorts of firms, if book value appears too high or too low when compared to a company's market cap, it may not necessarily indicate an overvalued or undervalued stock, but rather the fact that the bulk of its assets are intangible assets.

The financial takeaway

Book value is used by investors to gain an objective estimate of a company's worth. Book value estimates the actual value of everything it owns, minus everything it owes. It consists of the company's total assets after you subtract the company's liabilities.

From there, value investors compare book value and its permutation, book value per share, to the price of the company's stock. That way, they determine whether its shares are overpriced or underpriced.

It's important to use book value and book value per share in the right context, and with the right stocks. As measures they work better on industrial or old-line companies that own, make or hold tangible assets, as opposed to info tech or online service providers.

Still, it can be a start towards determining a company's fundamental worth - and a good buy.

Related Coverage in Investing:

What is common stock? The most typical way to invest in a company and profit from its growth

What is the P/E ratio? An analytical tool that helps you decide if a stock is a good buy at its current price

How to invest in dividend stocks, a low-risk source of investment income

What is a stock split, and is it a good or bad sign when it happens?

What is growth investing? A strategy that focuses on high-growth companies in hopes for significant investment returns

Dit artikel is oorspronkelijk verschenen op z24.nl